Focos

Un «gestor de cartera» es un tipo de gestor financiero o gestor de fondos de inversión.

Gestor de inversiones, gestor de activos, gestor de fondos, gestor patrimonial, analista de carteras, analista de inversiones, estratega de inversiones, estratega de carteras, especialista en carteras, responsable de inversiones.

Un gestor de carteras es responsable de invertir los fondos aportados por los inversores. Los fondos pueden proceder de una empresa de capital riesgo, fondos de inversión, fondos de cobertura u otros originadores de inversiones. Ellos decidirán la mejor manera de invertir el dinero para obtener beneficios. Seleccionan inversiones específicas y ejecutan operaciones en el mercado.

- Ayudando a otros a tener éxito en sus inversiones.

- Para tener éxito, hay que estar al tanto de la actualidad y tomar decisiones importantes.

- Bien remunerado y apreciado en este puesto.

- Un trabajo desafiante cada día.

Un gestor de carteras puede ser una persona individual o trabajar con un grupo que gestione la misma cartera. Durante su jornada laboral, dedicará mucho tiempo a reuniones, llamadas telefónicas, responder correos electrónicos o mensajes de texto. Durante este tiempo, puede esperar:

- Estudiar las tendencias económicas, así como los acontecimientos actuales y cómo estos pueden afectar a los mercados financieros.

- Analizar los datos financieros y su rendimiento histórico.

- Analizar los datos de la empresa, así como el rendimiento individual de la misma.

- Redactar informes o crear presentaciones.

- Reúnete con inversores de alto nivel.

- Recomendar inversiones para los fondos.

Un gestor de carteras también puede optar por desempeñar un papel más activo en las inversiones que gestiona. Los gestores pasivos utilizarán datos para invertir en inversiones a largo plazo que, por lo general, se entiende que crecerán con el tiempo sin mucha interacción. Los gestores activos operarán con más frecuencia e intentarán superar el crecimiento del mercado. Los inversores decidirán qué tipo de inversión quieren que realicen sus gestores.

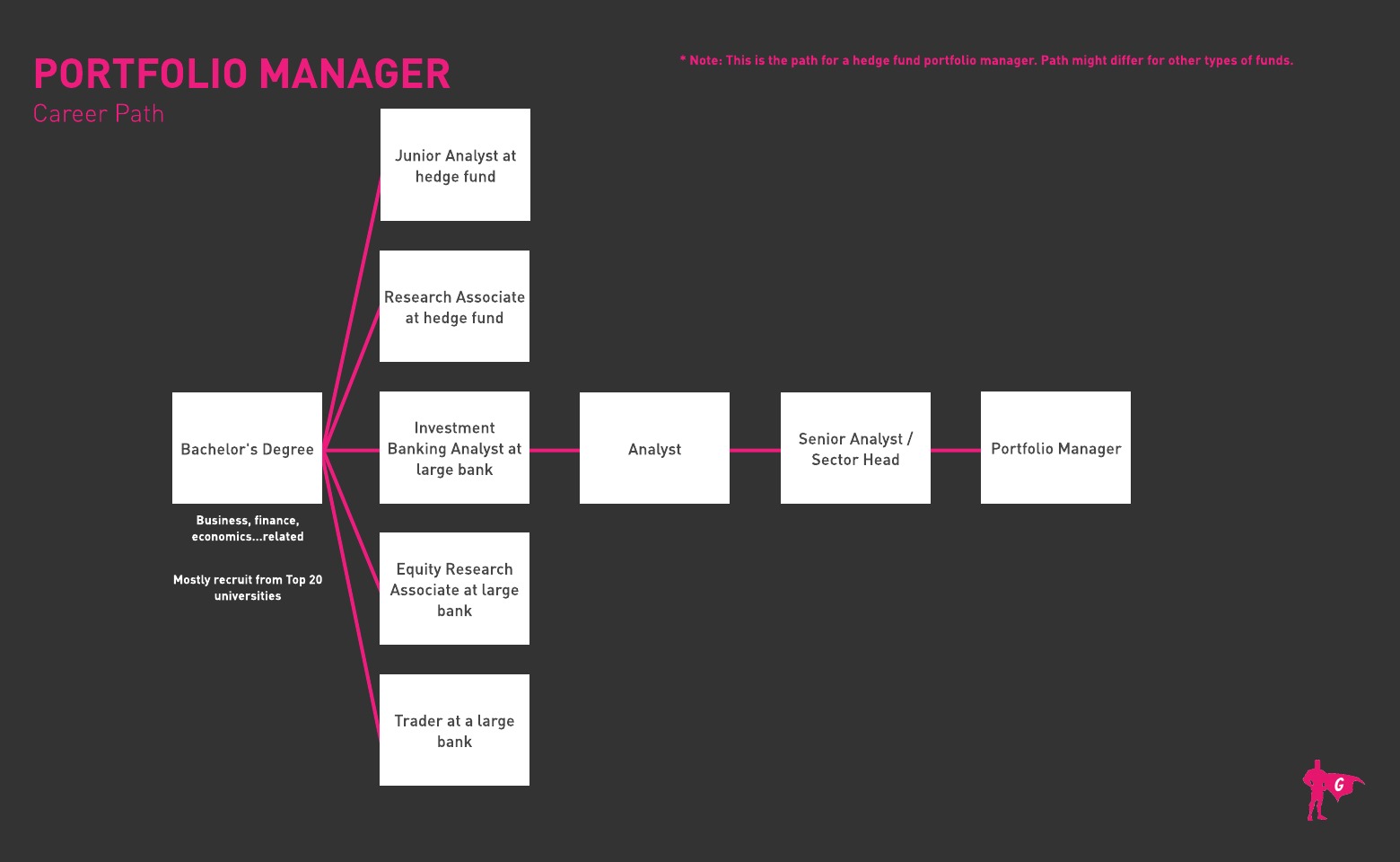

Para los gestores de fondos de cobertura

Si se trata de un fondo de cobertura con un único gestor, el gestor de cartera ha recaudado el capital y es responsable de la totalidad del mismo; si se trata de un fondo con varios gestores, se le ha asignado una determinada cantidad de activos bajo gestión (AUM) para invertir. Independientemente del tipo de fondo, el gestor de cartera toma las decisiones finales de negociación, supervisa el riesgo y toda la cartera, y supervisa las operaciones de back/middle office, como el cumplimiento normativo, las tecnologías de la información y la contabilidad.

EMPLEOS ANTERIORES ANTES DE CONVERTIRSE EN GESTOR DE CARTERAS:

Las tareas del analista incluyen:

- Seguimiento de las tendencias del sector y de la empresa.

- Hablar con la dirección, los clientes y los proveedores de empresas potenciales o actuales de la cartera.

- Responder a las preguntas de los analistas sénior y los gestores de cartera, y explicar y defender sus ideas.

- Generar ideas de inversión.

- Creación de modelos financieros y valoraciones para respaldar sus ideas.

- Realizar la debida diligencia, a menudo con visitas in situ y «comprobaciones de canales».

Las tareas del analista sénior (jefe de sección) incluyen:

- Tareas similares a las del analista, pero con responsabilidades adicionales:

- Como indican los nombres alternativos, a menudo te especializas en un sector, industria o estrategia.

- Dedicas más tiempo a presentar tus ideas a los gestores de cartera, a idear nuevas ideas y a pedir a los analistas que las desarrollen y respalden.

- Dedicas más tiempo a la gestión: formar a los analistas que están por debajo de ti para que te ayuden con el trabajo, ganarte la confianza de los gestores de proyectos y labrarte una reputación entre los analistas de investigación de valores y los equipos directivos.

- Fuertes habilidades de comunicación escrita y oral.

- Excelente en el análisis de datos y la comprensión de tendencias de datos.

- Razonamiento deductivo y comprensión de relaciones complejas de causa/efecto.

- Conocimientos informáticos, incluyendo procesamiento de textos, análisis de bases de datos y hojas de cálculo.

- Altamente cualificado en matemáticas, incluyendo cálculo y estadística.

- Habilidades de atención al cliente

- Administración y gestión.

- Economía y contabilidad.

- Empresas de gestión patrimonial

- Fondos de pensiones

- Fundaciones (fondos de dotación)

- Compañías de seguros

- Bancos

- Fondos de cobertura

- Sociedades de valores

Al igual que muchos puestos del sector financiero, los gestores de carteras suelen trabajar muchas horas. No se trata de un puesto de nivel inicial, por lo que es probable que tengas que trabajar durante algún tiempo en otro puesto relacionado con el análisis financiero. Esto significa que, antes de pasar a otro puesto, ya habrás tenido éxito en uno.

Los gestores de carteras suelen generar beneficios mediante el crecimiento de los valores públicos. Se está produciendo un aumento de la inversión a través de empresas de capital privado, lo que elimina parte de este potencial.

La gestión de carteras sigue aumentando su dependencia de la recopilación y el análisis de datos. También se ha incrementado el uso de la tecnología, ya que el software es capaz de realizar predicciones más complejas sobre el rendimiento de un valor.

También se observa un aumento en la gestión de aspectos que trascienden el ámbito financiero. Las empresas están desarrollando una mayor preocupación por el medio ambiente y la diversidad en sus recursos humanos. Algunos gestores de carteras están utilizando estas preocupaciones para ayudar a mejorar la percepción pública y los beneficios de una empresa.

- Llevar el marcador en eventos deportivos.

- Clases y lecciones de matemáticas.

- Dirigir negocios personales, como puestos de limonada.

- Ayudar a gestionar concesiones u otras actividades relacionadas con el negocio.

- Los gestores de carteras suelen tener una licenciatura en finanzas o un campo relacionado.

- Las clases comunes incluyen contabilidad, negocios, economía, finanzas, gestión de riesgos, matemáticas y temas relacionados con el mercado de valores.

- Completar un MBA es preferible y mejorará tus credenciales en un mercado laboral competitivo. Un máster también puede cualificarte para puestos avanzados, por lo que no tendrás que empezar desde un nivel junior.

- La experiencia laboral práctica es fundamental; la mayoría de los gestores de carteras trabajan durante años en puestos relacionados, como el análisis de investigación, antes de ser contratados para puestos de asistente.

- Las prácticas para analistas y estudiantes también son muy útiles para prepararse para las funciones de gestor de carteras.

- Los gestores de carteras deben completar un programa de certificación como analistas financieros colegiados.

- Las certificaciones como la de Gestor de Carteras Colegiado de la Academia de Gestores de Carteras Certificados, ofrecida en colaboración con la Universidad de Columbia, o el Curso Online de Certificado en Gestión de Activos y Carteras de Wharton también son útiles.

- Es posible que los gestores de carteras deban aprobar determinados exámenes de la Autoridad Reguladora de la Industria Financiera (FINRA) a lo largo de su carrera, dependiendo del alcance de sus funciones. En el caso de las cuentas de gran volumen, los gestores deben registrarse en la Comisión de Bolsa y Valores.

- Inscríbete en muchas clases de matemáticas, contabilidad, finanzas, estadística, análisis de datos, informática, estadística, derecho empresarial, economía, derecho tributario y banca.

- Desarrolla tus habilidades de redacción, oratoria y presentación.

- Aprenda a utilizar programas de software comunes como Personal Capital, Mint, Quicken Premier, Investment Account Manager, Morningstar Portfolio Manager o SigFig Portfolio Tracker.

- Estudia estrategias de inversión y mercados; prepárate para trabajar muchas horas una vez que te contraten, ya que los gestores de carteras pueden trabajar más de 60 horas a la semana y estar «de guardia» en caso de que se produzcan acontecimientos importantes que puedan afectar a los clientes.

- No esperes más para empezar a adquirir experiencia laboral práctica a través de puestos de analista de investigación o prácticas.

- Considera la posibilidad de obtener certificaciones como la de analista financiero colegiado, la de gestión de activos y carteras o la de gestor de carteras colegiado.

- Mantén tu perfil de LinkedIn actualizado y publica artículos para mostrar tus conocimientos.

- Escribe para Medium o envía artículos a publicaciones financieras en línea para mejorar tus credenciales.

- Únase a organizaciones profesionales como la Asociación Internacional de Finanzas Cuantitativas y el Instituto de Gestión de Carteras.

- Un gestor de carteras no es un puesto de nivel inicial. Tendrás que encontrar un puesto de nivel inicial como analista financiero en una empresa, normalmente como «analista junior». Estos puestos están abiertos a candidatos con título universitario. Los profesionales pasan varios años adquiriendo experiencia laboral antes de volver a la universidad para obtener un título de máster.

- También puedes conseguir unas prácticas durante la universidad y es posible que se conviertan en un trabajo a tiempo completo, así que esfuérzate y demuéstrales que estás comprometido con aprender todo lo posible.

- Esto, junto con su experiencia laboral, les proporciona la formación necesaria para ascender a un puesto de analista sénior. Se trata de una persona que trabaja directamente para el gestor de carteras y supervisa a un pequeño equipo de analistas júnior. Con el tiempo, si tienen éxito, pueden ascender a un puesto de gestor de carteras.

- Utiliza portales de empleo como eFinancialCareers, Financial Job Bank, Indeed, Simply Hired, Glassdoor y la bolsa de trabajo de la Asociación de Profesionales Financieros para encontrar oportunidades.

- Muchas personas en este campo consiguen sus puestos de trabajo ascendiendo dentro de sus empresas, así que busca empleadores para los que te veas trabajando durante mucho tiempo. Las empresas no quieren contratar simplemente a personas que buscan adquirir experiencia para luego marcharse en busca de un trabajo mejor.

- Difunde entre tu red profesional que estás buscando un puesto de gestor de carteras.

- Echa un vistazo a los ejemplos de currículums de Job Hero para obtener ideas sobre qué incluir, y al análisis en profundidad de Zip Recruiters sobre las mejores palabras clave y habilidades que debes incluir.

- ¡Invierte en los servicios de un redactor profesional de currículums para llevar tu currículum al siguiente nivel!

- Estudia las preguntas de la entrevista del gestor de carteras de Glassdoor antes de que empiecen a llover las llamadas para entrevistas.

- Una vez que seas gestor de carteras, dependiendo del tamaño de la empresa, podrás ascender a gestor sénior de carteras. Para muchos, este será el puesto más alto al que podrán aspirar. Sin embargo, es posible que encuentres un puesto de liderazgo en otra empresa o incluso que puedas crear tu propia empresa.

El paso de la universidad al puesto de gestor de carteras es sencillo. Comenzará en una empresa como analista junior y ascenderá si demuestra su éxito. Se espera que obtenga un título de máster en algún momento, a menudo mientras trabaja.

Los gestores de cartera suelen dirigir varios equipos a través de sus analistas sénior y no tienen mucho margen para ascender ellos mismos.

Sitios web

- Barron's

- Bloomberg

- CNBC Últimas noticias económicas

- Asociación de Gestión de Riesgos Fiduciarios y de Inversión

- Autoridad Reguladora del Sector Financiero

- Financial Times

- Fox Negocios

- Asociación Internacional de Finanzas Cuantitativas

- MarketWatch

- Instituto de Gestión de Carteras

- Calle de las Murallas

- La calle

- Diario Wall Street

Libros

- La nueva dinámica de la gestión de carteras: métodos y herramientas innovadores para obtener resultados rápidos, por Murali Kulathumani MBA.

- La norma para la gestión de carteras, del Project Management Institute.

- Gestión moderna de carteras: más allá de la teoría moderna de carteras, por Todd E. Petzel.

- Gestión de carteras: teoría y práctica, por Scott D. Stewart, Christopher D. Piros, et al.

- Banquero de inversión

- Gestor de fondos

- Finanzas corporativas

- Inversor de capital riesgo

- Trabajo en capital privado

En las finanzas, las relaciones pueden ser tan importantes como el dinero. Durante tus estudios y tus primeros pasos en el mundo laboral, es importante crear una red de contactos sólida. Cada persona con la que te encuentres podría ser una referencia en el futuro, por lo que es importante perfeccionar tus habilidades sociales. Ascender y encontrar puestos de trabajo depende de tus contactos, pero también de tu rendimiento en el trabajo.

Para ascender a un puesto de alto nivel en una empresa, deberá planificar su rendimiento en el ámbito financiero y, probablemente, obtener un título de máster. A continuación, deberá demostrar su éxito antes de obtener un puesto de gestor de carteras. Sin embargo, si es capaz de hacerlo, recibirá una buena remuneración y podrá acceder fácilmente a otros puestos financieros si lo desea.

Fuente de noticias

Empleos destacados

Cursos y herramientas en línea

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 131 000 dólares. El salario medio es de 165 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 214 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 168 000 dólares. El salario medio es de 217 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 315 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 120 000 dólares. El salario medio es de 159 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 208 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 117 000 dólares. El salario medio es de 162 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 209 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 111 000 dólares. El salario medio es de 157 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 197 000 dólares.