Focos

Analista, responsable de productos crediticios, analista de investigación de valores, analista financiero, analista de inversiones, analista de planificación, gestor de carteras, analista inmobiliario, analista de valores, responsable de fideicomisos.

Dicen que se necesita dinero para ganar dinero, y la inversión es la forma más común de hacerlo. Desde acciones y bonos hasta bienes raíces y criptomonedas, la inversión es uno de los métodos más probados y comprobados para obtener ganancias a largo plazo. Sin embargo, también es intrínsecamente arriesgado, ya que los mercados fluctúan constantemente debido a factores que afectan a las empresas y a la economía en su conjunto. No hay garantías de obtener un rendimiento de la inversión, y es muy posible perder todo el dinero.

Por eso, los inversores inteligentes recurren a analistas financieros que pueden asesorarles sobre las estrategias más adecuadas para su presupuesto, sus objetivos, su tolerancia al riesgo y sus plazos. Los analistas financieros estudian el comportamiento de las acciones, los bienes inmuebles y otros tipos de inversiones, y luego tratan de predecir su rendimiento futuro. Dado que hay tantos elementos humanos en la ecuación, este análisis es tanto un arte como una ciencia.

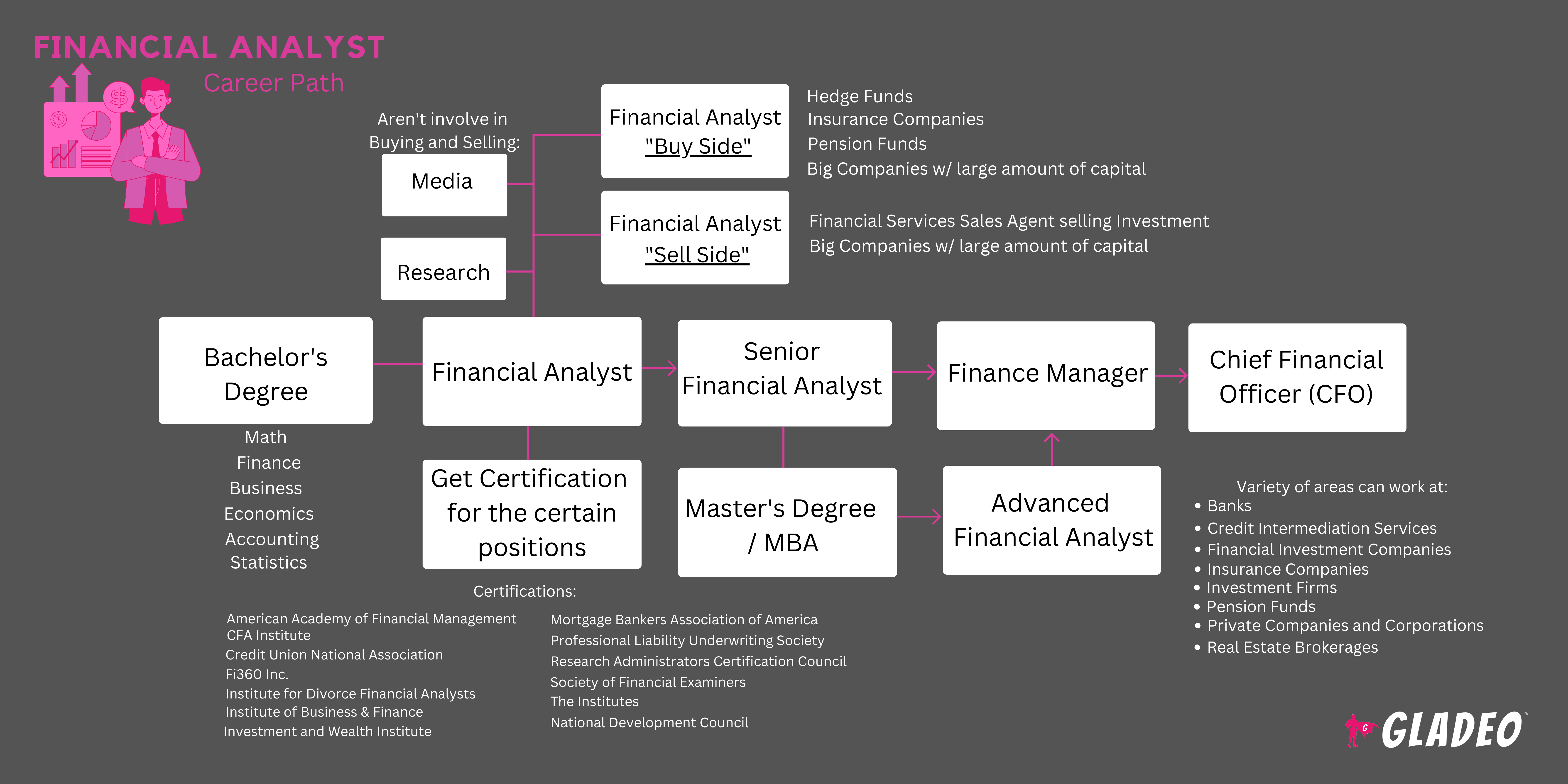

En términos generales, los analistas financieros se centran en el «lado comprador» (para fondos de cobertura, compañías de seguros, fondos de pensiones y grandes empresas con grandes cantidades de capital para invertir) o en el «lado vendedor» (para agentes de ventas de servicios financieros que venden opciones de inversión). Algunos trabajan exclusivamente para medios de comunicación y empresas de investigación que no se dedican a la compra o venta. Pueden especializarse en regiones, industrias o productos concretos.

¡El análisis financiero es un amplio campo profesional al que dedicarse! El término «analista financiero» abarca a especialistas en riesgos financieros, gestores de fondos y carteras, analistas de inversiones, analistas de calificación y analistas de valores. Cada función varía en cuanto a sus tareas y ámbito de responsabilidad, pero todas ellas están vinculadas al dinámico campo del análisis financiero.

- Ayudar a los empleadores a obtener beneficios que solían beneficiar a las empresas o a los particulares.

- Formar parte del mundo de las inversiones, que tiene repercusiones económicas en todas las personas del planeta.

- Aprender cómo funcionan las acciones (valores), los bonos, los activos reales (bienes inmuebles, materias primas como el oro o el petróleo) y las criptomonedas como inversiones.

Horario de trabajo

Los analistas financieros trabajan en horarios diarios habituales, con horas extras o trabajo nocturno según las necesidades de los clientes. El trabajo se realiza normalmente en interiores, con algunos desplazamientos ocasionales.

Funciones típicas

- Revisar las finanzas de los clientes (estados de resultados, balances generales, flujo de caja) para evaluar sus necesidades de capital, presupuestos de inversión y tolerancia al riesgo.

- Considerar los tipos de inversión y las carteras que se recomendarán a los clientes.

- Sugerir soluciones de inversión, reestructuración de la deuda, refinanciación y otras soluciones a los problemas financieros de un empleador.

- Prepare informes y materiales de presentación con gráficos explicativos para ayudar a los clientes a comprender las opciones.

- Estudie las empresas cuyas acciones podrían ser buenas inversiones potenciales. Realice visitas a las instalaciones, según sea necesario.

- Evaluar los datos históricos de ventas inmobiliarias para pronosticar si una propiedad es una inversión viable.

- Utilizar modelos y programas financieros para ayudar a desarrollar estrategias de inversión.

- Presta atención a las tendencias económicas y empresariales locales, nacionales y globales.

- Preparar y ejecutar planes de acción aprobados para inversiones financieras, transacciones y acuerdos.

- Trabajar con banqueros de inversión, contables, personal de relaciones públicas, abogados y otras partes relevantes.

- Evaluar el rendimiento de las inversiones existentes y recomendar ajustes o ventas.

- Busque nuevas oportunidades para diversificar, aumentar los beneficios potenciales y mitigar el riesgo.

- Compare valores de diversos sectores

- Analizar datos relativos a precios, rendimientos y estabilidad.

- Colaborar según sea necesario con las agencias gubernamentales. Garantizar el cumplimiento de las normativas y leyes.

- Ayudar a los clientes a comprender las implicaciones fiscales de las inversiones.

Responsabilidades adicionales

- Manténgase al día leyendo publicaciones financieras.

- Encuentre oportunidades de inversión «verdes»

- Anunciar servicios para atraer nuevos clientes, según sea necesario.

- Formar y orientar a los nuevos analistas.

Habilidades sociales

- Escucha activa

- Adaptabilidad

- Analítico

- Orientado al cumplimiento

- Pensamiento crítico

- Orientado a los detalles

- Disciplina

- Perspicacia financiera

- Paciencia

- Persistencia

- Persuasión

- Planificación y organización

- Habilidades para resolver problemas

- Escepticismo

- Buen juicio

- Fuertes habilidades de comunicación

- Trabajo en equipo

- Gestión del tiempo

Habilidades técnicas

- Habilidades matemáticas y contables

- Sólidos conocimientos de economía e inversiones.

- Conocimiento de las leyes aplicables que rigen el sector de valores, tales como:

- Ley Dodd-Frank de Reforma de Wall Street y Protección al Consumidor de 2010

- Ley de Asesores de Inversión de 1940

- Ley de Sociedades de Inversión de 1940

- Ley Jumpstart Our Business Startups (Jumpstart Nuestras Empresas Emergentes) de 2012

- Ley Sarbanes-Oxley de 2002

- Ley de Valores de 1933

- Ley de Bolsa de Valores de 1934

- Ley de Fideicomisos de 1939

- Software analítico como SAS, MATLAB, Spotfire, QlikView, Tableau y MicroStrategy.

- Otras herramientas digitales, como Excel, SQL, VBA, Python y R.

- Bancos

- Servicios de intermediación crediticia

- Sociedades de inversión financiera

- Compañías de seguros

- Fondos de pensiones

- Empresas privadas y corporaciones

- Agencias inmobiliarias

Los inversores confían en gran medida en la experiencia de sus equipos de analistas financieros. Las inversiones acertadas pueden equivaler a rentabilidad y estabilidad a largo plazo, lo que a menudo se traduce en trabajo continuo para los empleados de una empresa. Las malas inversiones pueden provocar que una empresa sufra pérdidas financieras significativas, lo que puede dar lugar a recortes de plantilla, despidos de trabajadores o incluso a la quiebra.

Las expectativas son altas y los analistas financieros deben trabajar duro para llevar a cabo investigaciones exhaustivas y crear modelos precisos que les permitan pronosticar las mejores inversiones para las necesidades de sus clientes. Como señala Zippia, «aunque los analistas financieros suelen cobrar bien, en muchos casos esto se consigue a costa de un equilibrio saludable entre la vida laboral y la personal». Las largas jornadas laborales y el estrés derivado de tanta presión hacen que algunos analistas sufran agotamiento.

La economía ha atravesado tiempos turbulentos, con los inversores viviendo una montaña rusa debido a las fluctuaciones impredecibles de los precios de las acciones, los fondos de inversión, los ETF, los bienes inmuebles y las criptomonedas. Esta volatilidad es lo contrario de lo que la mayoría de los analistas financieros desean ver cuando se trata de generar riqueza, pero últimamente no ha habido muchos refugios seguros. Existen opciones relativamente seguras, como cuentas de ahorro, bonos, letras del Tesoro y productos similares, pero es posible que el rendimiento de estas inversiones de bajo riesgo ni siquiera pueda seguir el ritmo de la inflación. Mientras tanto, algunos analistas sugieren aprovechar la bajada de los precios de las acciones y abogan por una estrategia de «comprar en la caída» mientras las acciones están «en oferta».

La digitalización de la moneda se ha convertido en una tendencia al alza, y muchos inversores consideran las criptomonedas y los NFT (tokens no fungibles) como una alternativa interesante a los vehículos de inversión tradicionales. De hecho, solo los inversores de capital riesgo invirtieron más de 33 000 millones de dólares en criptomonedas y blockchain en 2021. Mientras tanto, las aplicaciones de tradinghan revolucionado por completo la forma en que la gente común opera, lo que a su vez tiene un gran impacto en el mercado en general.

Es posible que a los analistas financieros siempre les haya gustado aprender sobre el dinero, cómo funciona y cómo se puede utilizar para ganar aún más dinero. De pequeños, es posible que fueran emprendedores que lanzaron sus propios negocios paralelos, ya fuera online o en persona. Quizás disfrutaban jugando con acciones y criptomonedas, operando a través de aplicaciones móviles y participando en foros online. Es posible que les gustaran las clases de matemáticas, finanzas, economía y programación en el colegio. Otros quizá acudían a ellos en busca de ayuda o consejo sobre inversiones, lo que les llevó a darse cuenta de que algún día podrían convertir sus habilidades en una profesión bien remunerada.

- Los puestos de analista financiero junior requieren como mínimo una licenciatura en economía, finanzas, empresariales, matemáticas o una titulación relacionada.

- Las grandes empresas pueden preferir analistas con un título de máster, como un MBA.

- Algunas funciones de analista requieren conocimientos de física, matemáticas aplicadas y principios de ingeniería.

- Existen numerosas certificaciones que pueden ayudarte a cualificarte para determinados puestos. Entre ellas se incluyen:

- Academia Americana de Gestión Financiera - Analista Financiero Acreditado

- CFA Institute - Analista financiero certificado

- Asociación Nacional de Cooperativas de Crédito - Profesional certificado en inversiones de cooperativas de crédito

- Fi360 Inc. - Fiduciario de inversiones acreditado

- Instituto de Analistas Financieros de Divorcio - Analista Financiero de Divorcio Certificado

- Instituto de Negocios y Finanzas -

• Especialista certificado en ingresos

• Especialista certificado en fondos

- Instituto de Inversión y Patrimonio - Analista Certificado en Gestión de Inversiones

- Asociación de Banqueros Hipotecarios de Estados Unidos - Suscriptor residencial certificado

- Sociedad de Suscripción de Responsabilidad Profesional - Suscriptor de Responsabilidad Profesional Registrado

- Consejo de Certificación de Administradores de Investigación - Administrador Financiero Certificado de Investigación

- Sociedad de Examinadores Financieros -

• Examinador financiero certificado - Analista financiero

• Examinador financiero acreditado - Analista financiero

- Los Institutos - Asociado en Suscripción Comercial

- Consejo Nacional de Desarrollo - Profesional de Finanzas para el Desarrollo Económico

- Los analistas financieros que venden productos necesitan una licencia expedida por la Autoridad Reguladora de la Industria Financiera(FINRA). Las licencias suelen obtenerse después de que el analista comienza a trabajar.

- Intenta decidir pronto si quieres cursar un máster o no. Puede que te resulte más fácil completar tanto la licenciatura como el máster en la misma universidad.

- Ten en cuenta el costo de la matrícula, los descuentos y las oportunidades de becas locales (además de la ayuda federal).

- Piensa en tu horario y flexibilidad a la hora de decidir si matricularte en un programa presencial, online o híbrido.

- Echa un vistazo a los premios y logros del profesorado del programa para ver en qué han trabajado.

- Revisa las estadísticas de inserción laboral y los detalles sobre la red de antiguos alumnos del programa.

- Considera solicitar empleos a tiempo parcial en contabilidad o finanzas.

- Estudia mucho en las clases de matemáticas, finanzas, economía, estadística, negocios, física e informática/programación.

- Ofrecerse como voluntario para actividades estudiantiles en las que se pueda gestionar dinero y aprender habilidades sociales prácticas.

- Conozca los distintos tipos de puestos de analista financiero, como especialistas en riesgo financiero, gestores de fondos y carteras, analistas de inversiones, analistas de calificación y analistas de valores.

- Revisa con antelación las ofertas de empleo para ver cuáles son los requisitos medios. Si sabes en qué empresa o para qué empleador quieres trabajar, solicita una entrevista informativa con uno de sus analistas en activo para obtener más información sobre sus puestos de trabajo y las necesidades de sus clientes.

- Busca prácticas y experiencias cooperativas en la universidad.

- Anota los nombres y datos de contacto de las personas que podrían servir como referencias laborales en el futuro.

- Estudia libros, artículos y tutoriales en vídeo relacionados con diferentes tipos de inversión. Participa en grupos de debate online que sean realistas y se basen en análisis reales.

- Considera si deseas especializarte en una región, industria o tipo de inversión en particular, para que puedas adaptar tu formación en consecuencia.

- Colabora con organizaciones profesionales para aprender, compartir, hacer amigos y ampliar tu red de contactos (consulta nuestra lista de Recursos > Sitios web).

- Obtenga todas las certificaciones pertinentes tan pronto como pueda para reforzar sus credenciales y ser más competitivo en el mercado laboral.

- Empieza a redactar tu currículum con antelación y ve añadiendo información a medida que avanzas, para no perderte nada.

- Si es posible, adquiere algo de experiencia laboral práctica antes de presentar tu solicitud. Los trabajos relacionados con las finanzas, la contabilidad y los negocios quedarán bien en tu solicitud.

- No es necesario tener un máster para empezar a trabajar en este campo, pero un título de posgrado puede darte ventaja sobre la competencia.

- Haz saber a tu red de contactos que estás buscando trabajo. La mayoría de las oportunidades laborales se descubren a través de contactos personales.

- Echa un vistazo a portales de empleo como Indeed, Simply Hired y Glassdoor, así como a las páginas de empleo de las empresas en las que te interesa trabajar.

- Selecciona cuidadosamente los anuncios y solo postúlate si cumples con todos los requisitos.

- Las prácticas relacionadas con las finanzas o las experiencias cooperativas pueden ayudarte a abrirte camino. Quedan muy bien en los currículos y pueden proporcionarte referencias personales para el futuro.

- Póngase en contacto con analistas financieros en activo para pedirles consejos sobre la búsqueda de empleo.

- ¡Múdate al lugar donde hay más oportunidades laborales! Los estados con mayor nivel de empleo para analistas financieros son Nueva York, California, Texas, Illinois y Florida.

- Muchas grandes empresas contratan a graduados de programas locales, así que pide ayuda al programa o al centro de orientación profesional de tu universidad para ponerte en contacto con reclutadores y ferias de empleo.

- Los centros de orientación profesional también ofrecen ayuda para redactar currículos y simular entrevistas.

- Pregunte con antelación a sus antiguos profesores y supervisores si estarían dispuestos a servir como referencias personales. No los pille desprevenidos incluyendo su información de contacto sin su permiso.

- Crea una cuenta en Quora para pedir consejos laborales a personas que trabajan en ese campo.

- Echa un vistazo a las plantillas de currículum de analista financiero para obtener ideas.

- Adapta tu currículum al puesto de trabajo que solicitas, en lugar de enviar el mismo currículum a todos los empleadores.

- Enumera toda tu formación académica, habilidades, capacitación y experiencia laboral en tu currículum, incluyendo estadísticas sobre el retorno de la inversión (si procede).

- Considera la posibilidad de que un redactor o editor profesional de currículums redacte o revise tu currículum.

- Preguntas de entrevista para analistas financieros con las que prepararse para esas entrevistas.

- ¡Vístete adecuadamente para tener éxito en la entrevista de trabajo!

- Consiga de forma constante un alto rendimiento de la inversión para sus empleadores/clientes y cree carteras que puedan capear las tormentas económicas.

- Trabaja horas extras según sea necesario, para asegurarte de que estás haciendo todo lo posible por aquellos que te han confiado sus fondos.

- Asume con seriedad tus responsabilidades al manejar el dinero de otras personas.

- Comprender y cumplir todos los requisitos legales y éticos.

- Utilice los programas y técnicas más actualizados para maximizar los rendimientos.

- Aprende todo lo que puedas sobre los distintos aspectos del análisis financiero, al tiempo que te especializas en el campo que hayas elegido.

- Espera comenzar en puestos de nivel inicial y luego ascender a puestos de mayor responsabilidad, como gestor de carteras o gestor de fondos.

- Obtenga su licencia FINRA tan pronto como pueda y consiga certificados avanzados cuando tenga suficiente experiencia laboral.

- Una de las certificaciones más comunes es la credencial de Analista Financiero Certificado que ofrece el CFA Institute.

- Si aún no tienes un máster, considera la posibilidad de cursar un programa MBA nocturno mientras trabajas.

- Informe a su gerente cuando esté listo para abordar proyectos más grandes o más numerosos.

- Colabora eficazmente en equipo, mantén la calma y la concentración, y demuestra tu liderazgo cuando surjan oportunidades.

- Amplíe su red de contactos participando en organizaciones profesionales.

Sitios web

- Academia Americana de Gestión Financiera

- Asociación de Profesionales Financieros

- Instituto CFA

- Asociación Nacional de Cooperativas de Crédito

- Fi360 S.A.

- Autoridad Reguladora del Sector Financiero

- Academia Global de Finanzas y Gestión

- Instituto de Analistas Financieros en Divorcios

- Institute of Business & Finance

- Instituto de Inversión y Patrimonio

- Asociación de Banqueros Hipotecarios de Estados Unidos

- Consejo Nacional de Desarrollo

- Sociedad de Suscripción de Responsabilidad Profesional

- Consejo de Certificación de Administradores de Investigación

- Sociedad de Examinadores Financieros

- Los institutos

Libros

- Análisis fundamental para principiantes: haga crecer su cartera de inversiones como un profesional utilizando los estados financieros y los ratios de cualquier empresa sin necesidad de tener experiencia en inversiones, por A.Z Penn.

- Inversión 101: De acciones y bonos a ETF y OPI, una guía básica esencial para crear una cartera rentable, por Michele Cagan, CPA.

- Análisis técnico de los mercados financieros: guía completa sobre métodos y aplicaciones de negociación, por John J. Murph.

- Lo esencial del análisis financiero, por Samuel Weaver

Trabajar como analista financiero puede resultar estresante en ocasiones, especialmente cuando la economía es inestable y resulta más difícil obtener una buena rentabilidad de las inversiones. A menudo, se culpa a los analistas por resultados basados en factores que escapan totalmente a su control. Según la Oficina de Estadísticas Laborales, algunas profesiones relacionadas que se pueden tener en cuenta son:

- Analista presupuestario

- Gerente financiero

- Suscriptor de seguros

- Asesor financiero personal

- Agente de ventas de valores, materias primas y servicios financieros

Además, O*Net Online enumera los siguientes campos relacionados:

- Analista de crédito

- Especialista en riesgos financieros

- Gestor de fondos de inversión

Fuente de noticias

Empleos destacados

Cursos y herramientas en línea

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 79 000 dólares. El salario medio es de 94 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 114 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 107 000 dólares. El salario medio es de 132 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 170 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 92 000 dólares. El salario medio es de 115 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 133 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 93 000 dólares. El salario medio es de 119 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 182 000 dólares.

Expectativas salariales anuales

Los nuevos trabajadores comienzan con un salario de alrededor de 85 000 dólares. El salario medio es de 104 000 dólares al año. Los trabajadores con mucha experiencia pueden ganar alrededor de 124 000 dólares.